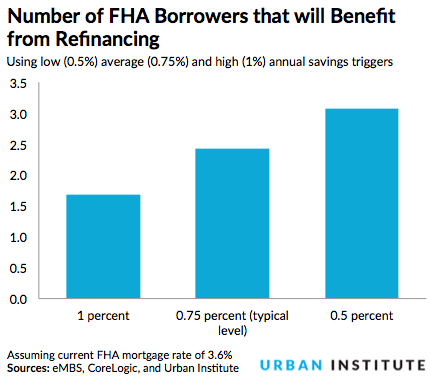

President Obama announced during the first week of January that there would be a 0.5 percentage point cut in the Federal Housing Administration’s (FHA) annual Mortgage Insurance Premium (MIP) – from 1.35 percent to 0.85 percent. Since the announcement, economists have tried to estimate the number of existing FHA borrowers that could benefit from refinancing as this activity is a key driver of FHA’s premium revenues and of the Mutual Mortgage Insurance (MMI) Fund’s overall health. We’ve also taken a closer look at the impact of the premium cut on FHA refinance volumes and have concluded that roughly 2.4 million current FHA borrowers could benefit from refinancing.

We began with 6.6 million existing FHA loans and excluded the following three categories of loans:

We began with 6.6 million existing FHA loans and excluded the following three categories of loans:

- 1.1 million loans originated prior to June 2009: Borrowers with FHA mortgages that were originated prior to June 1, 2009 are eligible for FHA’s Streamlined Refinance program. This program allows grandfathering of the pre-June 2009 annual MIP of 0.55 percent, and also reduces the upfront MIP to just 0.01 percent for these borrowers. Because these rates are significantly lower than FHA’s current premiums, pre-June 2009 FHA borrowers are essentially unaffected by the latest premium cut and are therefore excluded from our analysis.

- 0.8 million delinquent and modified loans: We also excluded 0.5 million borrowers who we estimated to be delinquent, and an additional 0.3 million with modified mortgages.

- 0.3 million loans with a term of 15 years of less: FHA’s latest premium cut does not apply to mortgages with a term of 15 years or less. These mortgages are also excluded from our analysis.

After excluding pre-June 2009 originated, delinquent, modified and mortgages with a maximum term of 15 years, (total 2.2 million), we estimated that roughly 4.4 million FHA borrowers could be candidates for refinancing. Not all of them will save money by refinancing, however, and many won’t refinance even when savings exist.

Borrowers who will find refinancing cost effective: Of the 4.4 million borrowers who can refinance, many will choose not to, primarily because the savings might be very little or might not be enough to cover the cost of refinancing (such as closing costs). This is especially true for borrowers who have lower loan balances. In general, borrowers stand to save money by refinancing if the new mortgage rate and the new FHA premiums, combined, result in a 0.75 percent reduction or more in annual mortgage costs.

We used this as the base for our final estimate, assuming that the majority of borrowers would adopt this threshold. Some borrowers are more conservative, of course, and might wait until their annual mortgage cost savings hits 1 percent to refinance, resulting in less refinance activity. Other borrowers are aggressive and might jump in when they stand to gain only 0.5 percent, which would result in more refinance activity. We’ve estimated these higher and lower triggers as well to give a clearer sense of the full range of potential refinance activity.

- Under our 0.75 percent threshold which we expect the majority of borrowers to adhere to, we estimate that roughly 2.4 million FHA borrowers could lower their mortgage payments even after accounting for refinancing costs. This represents over a third of the 6.6 million FHA borrowers.

- Using a more conservative threshold of 1 percent, roughly 1.7 million borrowers could save money by refinancing.

- At the more aggressive 0.5 percent threshold, our estimate rises to over 3 million. (Note that very few borrowers – primarily those with higher loan balances or those who missed the last refinance window – would find refinancing cost effective at the 0.5 percent threshold).

Our estimates are also based on the current FHA mortgage rate. A continued decline in rates could make refinancing appealing to a greater number of borrowers and would raise our estimates, whereas an increase in rates would lower them. Other unknowns such as borrowers’ expectations of future mortgage rates can also affect refinance activity. If a large number of borrowers decide to wait in anticipation of even lower rates in the future, that would further reduce refinance volumes. Given what we know today, however, one in three FHA borrowers could certainly lower their monthly payments by refinancing. Photo Richard Cavalleri/Shutterstock:

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.