Many, including the U.S. Treasury, have questioned whether private mortgage insurance provides adequate protection for Fannie Mae and Freddie Mac (the government sponsored entities or GSEs) and, ultimately, the taxpayers against systemic risk. But our review of data newly released by Freddie Mac indicates that mortgage insurance is better at cushioning taxpayers from GSE losses than most realized.

Borrowers of GSE-guaranteed mortgages are required to purchase private mortgage insurance (PMI) when they are not able to put down at least 20 percent of the loan’s value at the time of purchase. This insurance is designed to reduce Fannie and Freddie’s potential losses to levels comparable or even lower than losses associated with a higher down payment loan or a loan with a lower loan-to-value (LTV) ratio. For example, standard practice is for PMI to reduce the GSE’s exposure in an 85 LTV mortgage to the equivalent of that in a 73 LTV; a 95 LTV loan to the risk of a 65 LTV; and a 97 LTV mortgage to the risk of a 63 LTV.

Policymakers, including the U.S. Treasury, have been concerned, however, about ensuring that an industry so exposed to a single form of risk can withstand acute market pressure on that risk. When home prices decline sharply and mortgage insurance claims spike, will mortgage insurers honor the entirety of their claims? The PMIs’ poor performance coming out of the housing crisis led skeptics to believe that they won’t.

As discussed in our recent report - Putting Mortgage Insurers on Solid Ground - the proposed Federal Housing Finance Agency’s Private Mortgage Eligibility Requirements (PMIERs) rule should, with some modest changes, succeed in ensuring that PMI is a much-improved bulwark against excessive risk in the system. The new rule, coupled with today’s analysis which shows that the PMIs have actually been more effective in protecting the GSEs against losses than many appreciate, should give substantial comfort to the skeptics.

New, concrete evidence of the success of PMI

Freddie Mac, in November 2014, added data on loan behavior after a credit event (going 180 days delinquent, terminating prior to 180 days delinquent due to a deed-in-lieu, short sale, foreclosure sale, or REO sale) to its 2013 loan-level dataset. The original data, in support of Freddie Mac’s risk-sharing transaction—Structured Agency Credit Risk (STACR)—include information about loans that experience credit events. The new data allow us to determine, for the first time, the loss severities associated with these loans at liquidation, or the percent of unpaid principal balance that is ultimately lost at the time of default.

A lesson from the newest data

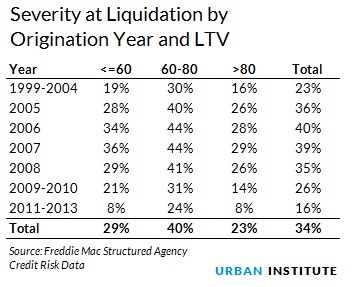

There are several lessons from the newest data, but one in particular stands out: Private mortgage insurance is protecting taxpayers from losses with GSE-guaranteed loans more effectively than many assumed. In every issue year examined, when loans experienced a credit event, private mortgage insurance did its job and kept the losses for high-LTV loans generally below the losses experienced by lower LTV loans. In fact, in every issue year, mortgages with the highest LTV (>80) had a significantly lower loss severity than the middle LTV mortgages (60-80) and, in all but the latest three years, lower severity than mortgages with the lowest LTV (≤60). (See table) This pattern holds true even for loans originated near the peak of the market (2006), even though severity was much higher for these loans as they ultimately experienced greater home price depreciation.

To put it simply, mortgage insurance is doing precisely what it was designed to do: lowering actual losses on higher LTV loans to levels seen in much lower LTV loans. A more complete analysis of this topic, and well as other lessons from this new data can be found in our issue brief: Loss Severity on Residential Mortgages: Evidence from Freddie Mac’s Newest Data.

Photo: nikkytok/shutterstock.com

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.