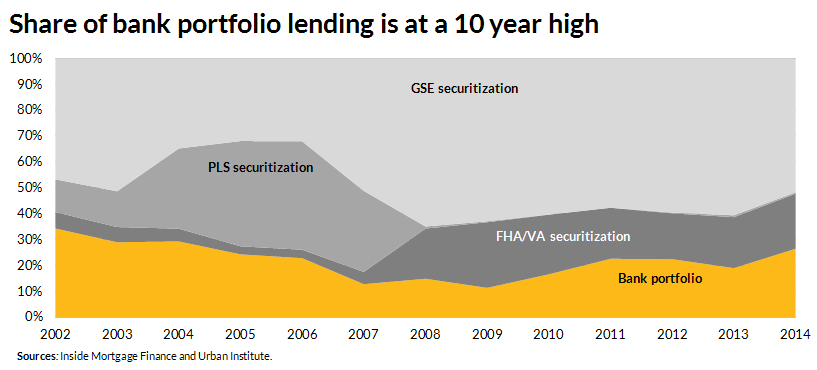

The Housing Finance Policy Center’s (HFPC) March Chartbook (page 8), released today, reveals that portfolio loans – which are held on lender balance sheets and are not government-backed – accounted for roughly 27 percent of total 2014 originations, the highest level in a decade. Three reasons explain this trend, which could potentially lead to government-sponsored enterprises (GSEs), and ultimately taxpayers, holding a higher concentration of lower credit quality loans.

- Share of Jumbo loans grew in 2014 – Although overall mortgage originations declined by 34 percent in 2014, non-agency jumbo share of total originations actually increased from 14 percent in 2013, to 19 percent in 2014 according to Inside Mortgage Finance. Because these mortgages have loan amounts that exceed GSE loan-limits, they are ineligible for purchase by GSEs. Jumbo borrowers also tend to be highly creditworthy, which mitigates lender concerns about default risk, further incentivizing them to hold these loans on their balance sheets. Finally, the near-absence of the private-label securities (PLS) market post-crisis has curtailed lender execution options, resulting in more loans being held in portfolios.

- Higher guarantee-fees (g-fees) charged by Fannie Mae and Freddie Mac – In the absence of the PLS market, lenders have two execution options for conventional mortgages – sell mortgages to GSEs (and cede the g-fee income), or retain loans on balance sheets (and keep the g-fee income). All else being equal, lenders are more likely to keep loans on their balance sheets if they believe g-fees are high enough to cover the risk of default. Because g-fees have increased substantially from roughly 0.2 percent pre-crisis to well over 0.5 percent currently, lenders are finding it much more profitable to retain higher quality mortgages and keep the g-fee income, as opposed to selling and ceding g-fees to the GSEs.

- Economy has improved – Recent improvements in the economy, as witnessed by broad-based house prices increases, rising interest rates and falling unemployment, have eased lenders’ worries about mortgage defaults. This in turn has made lenders slightly less risk-averse and more willing to hold mortgages in their portfolios.

The Federal Housing Finance Agency (FHFA) is set, in the coming weeks, to announce new g-fees for the GSEs. As discussed above, higher g-fees have given lenders a major incentive to hold more mortgages on their balance sheets and profit from the g-fee income. Because this growth is fueled predominantly by pristine quality mortgages, it could eventually result in fewer such mortgages being available for purchase by the GSEs. While overall credit quality of current originations remains very high and adverse selection is presently not a major concern, as the credit box opens in the coming years, higher g-fees relative to risk of underlying mortgages could eventually lead to a bifurcation of credit risk – with higher-quality loans being held in banks portfolios and lower-quality loans being guaranteed by the GSEs. As we await FHFA’s final rule on g-fees, it seems likely that keeping g-fees at current levels, or increasing them further, would only exacerbate this trend.

Our New Chartbook Highlight Feature:

HFPC’s Chartbook, published monthly, is a compilation of easy to understand graphs and charts that provide a quick, but comprehensive snapshot of the mortgage market. As the mortgage market revamp continues – either in response to market forces or new regulatory requirements – our Chartbook has become a “one stop shop” for policymakers, regulators, stakeholders and the general public to get a quick pulse on the mortgage market. With today’s post, we are initiating a new regular Chartbook Highlight feature where we’ll discuss a particularly interesting chart in greater detail to highlight a specific mortgage market trend and related policy implications. Please let us know your thoughts and feel free to send us suggestions for next month’s highlight.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.